Mortgage approvals for house purchases in the UK rose in January, suggesting a strong start to the year for the housing market, as successive interest rate cuts by the Bank of England (BoE) eased mortgage costs.

A total of 66,189 mortgages were approved for house purchases in January, marking an 18% increase compared with the same month in 2024, according to data from the BoE. The figure was only slightly lower than the 66,505 approvals recorded in December.

Meanwhile, net mortgage lending increased by £900m to £4.2bn in January, with the annual growth rate for net lending rising to 1.8% from 1.5% in December – extending an upward trend that has been in place since April 2024.

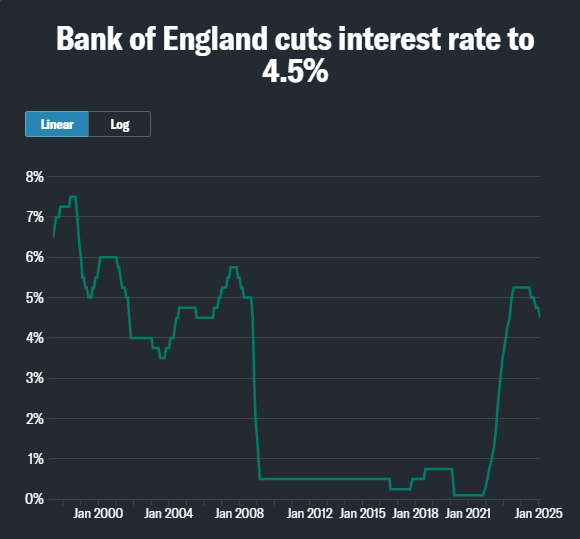

The BoE reduced its interest rate to 4.5% in February, its lowest level in 20 months, offering some relief to mortgage holders across the UK.

This was the third cut to UK borrowing costs in the current cycle, following reductions in August and November last year.

Meanwhile, net mortgage lending increased by £900m to £4.2bn in January, with the annual growth rate for net lending rising to 1.8% from 1.5% in December – extending an upward trend that has been in place since April 2024.

The BoE reduced its interest rate to 4.5% in February, its lowest level in 20 months, offering some relief to mortgage holders across the UK.

This was the third cut to UK borrowing costs in the current cycle, following reductions in August and November last year.

Gross lending remained stable at £21.3bn, while gross repayments fell to £16.3bn from £18.5bn in December. Net mortgage approvals, which serve as an indicator of future borrowing, saw a marginal decline of 300 to 66,200 in January, following a 400 increase the previous month. However, approvals for remortgaging increased to 32,900, up by 2,200, after consecutive declines in the preceding months.

The effective rate on new personal loans to individuals declined by 6 basis points to 8.79%, while individuals borrowed £4.2bn of mortgage debt.

Simon Gammon, managing partner at Knight Frank Finance, said: “The mortgage market remained busy in January, largely due to first time buyers squeezing deals through ahead of the changes to stamp duty and needs-based buyers that had put off acting during the volatility of 2024.

“The year began with more turbulence in bond markets, however mortgage rates have since eased on signs that the medium-term outlook for inflation looks fairly positive. That gave lenders the confidence to bring two- and five-year fixed rate deals below 4% this month.

“The short-term outlook is a different matter altogether. Inflation is likely to spike in the third quarter and, though Bank of England policymakers are convinced it will be a temporary bump, it may exert some upwards pressure on mortgage rates. Borrowers can expect another year of alarming headlines, with mortgage rates ebbing and flowing around this level until we get a more positive shift in the outlook.”

Nathan Emerson, chief executive of Propertymark, underscored the housing market’s resilience despite economic headwinds, including persistently high base rates. “Recent data from our member agents shows an almost 40% increase in sales agreed compared with the same period last year,” he said.

Emerson added that a reduction in the Bank of England’s base rate, when conditions allow, would be welcome news. “It would also be beneficial to see lenders introduce more competitive mortgage products,” he said.

Jonathan Samuels, CEO of specialist lender Octane Capital, commented: “A momentary monthly dip in mortgage approval numbers is to be expected either side of the Christmas break and so the marginal decline seen in January certainly doesn’t suggest the market is running out of steam.

“In fact, UK homebuyers appear to have begun the year on the front foot and the real indicator of market health is the fact that total mortgage approval numbers have remained above the 60,000 monthly benchmark for a full year now, not to mention they are also up 18.3% year on year.

Elsewhere, net consumer credit borrowing surged to £1.7bn in January, up from £1.1bn in December, driven primarily by an increase in credit card borrowing. Households borrowed £1.1bn on credit cards, the highest level since November 2023 and up sharply from £400m in the previous month.

Ashley Webb, UK economist at Capital Economics, said the rise in consumer borrowing suggested that some households had financed January’s 1.7% month-on-month increase in retail sales through unsecured credit.

However, Webb warned that the wider economic outlook remained weak. “The stagnating economy is partly due to households continuing to prioritise saving over spending,” he said. “This is unlikely to change in the next six months given the sharp deterioration in employment prospects.”

Households’ deposits with banks and building societies increased by £8.4bn in January, following net deposits of £4.7bn in December. This was driven by households depositing an additional £5.4 bn and £2.2bn into interest-bearing sight accounts and ISAs, respectively.

Households also deposited £1.2bn into non-interest-bearing sight accounts and withdrew £1.4 bn from interest-bearing time accounts . The effective interest rate paid on individuals’ new time deposits with banks and building societies fell by 5 basis points, to 3.91% in January.

Alice Haine, personal finance analyst at Bestinvest by Evelyn Partners, said: “Savers deposited an additional £8.4bn into their bank and building society accounts in January, almost doubling December’s £4.7bn uplift – perhaps a reflection of households battening down the hatches as they prepared for a difficult year ahead. Consumer confidence was low at the start of this year as households absorbed the implications of Rachel Reeves’ ‘painful’ budget in October last year.

“Those that did manage to give their savings a boost at the start of the year may have been disappointed by easing savings rate on regular bank and building society accounts. This was reflected in the effective interest rate – the actual interest paid on new fixed accounts – which fell by 5 basis points to 3.91% in January.

"While this still gives savers with the best savings deals a real return on their cash savings, once inflation is factored in, it is the post-tax net return on that cash that is key, particularly for higher rate taxpayers."

Are you looking at selling your Solihull home? BU Homes is an independent Solihull Estate Agent based in Olton. We will provide you with the best marketing to reach buyers, providing stunning virtual tours, floors plans and professional photography to sellers. We were the 'Gold' winners at the British Property Awards for the Solihull region. Book your free property valuation today.